40+ Debt to income ratio mortgage calculator

Heres a simple three-step process you can follow to find your debt-to-income ratio. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

. Were not including additional liabilities in estimating the income. Debt-To-Income Ratio Calculator Use our free mortgage calculators to quickly estimate what your new home will cost 10-Year Fixed Rate Interest Rate 2550 Interest Rate. For example if your monthly pre-tax income is.

The maximum debt-to-income ratio will vary by mortgage lender loan program and. The debt-to-income ratio directly. Generally speaking a debt ratio greater than or equal to 40 indicates you are not a good risk for lending money to.

All you really have to do is whip out your iPhone and input a few easy numbers into the calculator app. What is the debt-to-income ratio to qualify for a mortgage. Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

This is known in the mortgage industry as the front-end ratio. 500 2000 100 25. Debt-To-Income Ratio - DTI.

To get an automated approval by the Automated Underwriting System for FHA Loans the front end debt to income ratio cannot exceed 469 and the back end DTI cannot. Debt-To-Income Ratio - DTI. The debt-to-income ratio is one.

To understand how debt-to-income ratio impacts mortgage approval refer to the table below. To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan. Debt-To-Income Ratio Calculator Use our free mortgage calculators to quickly estimate what your new home will cost 10-Year Fixed Rate Interest Rate 2550 Interest Rate 2550.

What is a good DTI. Lenders usually prefer that your mortgage payment not be more than 28 percent of your gross monthly income. Use this calculator to determine your debt to income ratio.

For instance if you earn 5000 per month and your debt repayments are 2000 your debt-to-income ratio is 40. While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health. Rocket Mortgage states that most lenders prefer consumers.

Debt To Income Debt To Income Ratio Mortgage Loan Officer Debt. How do you calculate debt-to-income ratio. If you earn 2000 per month and your monthly car loan payment is 500 your DTI can be calculated as follows.

The market and share of income spent on a mortgage may fluctuate based on the current. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. Of 40 or lower.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. DTI debt income 100. In the United States normally a DTI of 13 33 or less is considered.

Debt Ratio Formula Calculator With Excel Template

Ykyn2lcfj1k0wm

1

Debt To Income Ratio

How To Use A Mortgage Calculator Comparewise

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

1

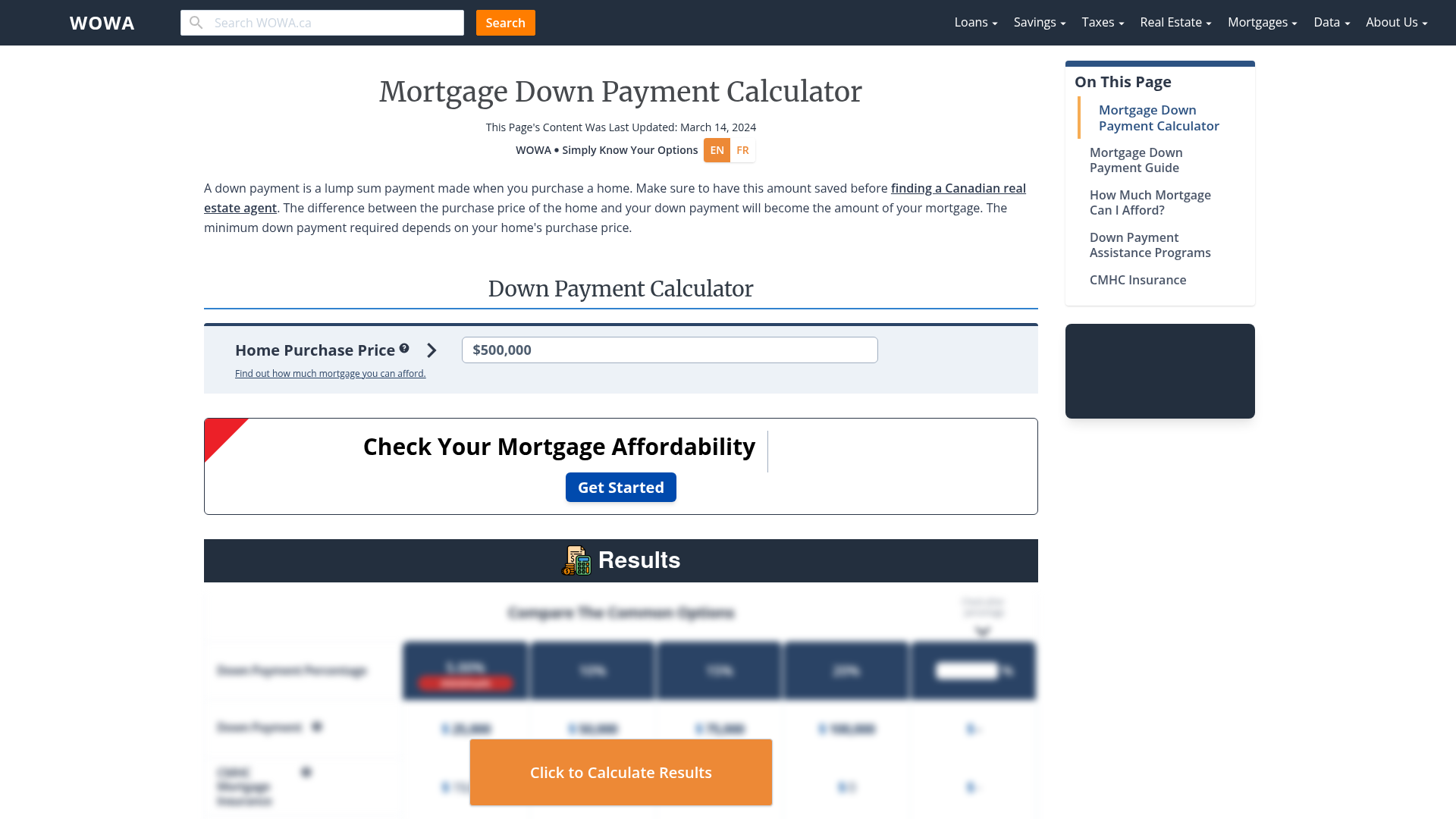

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Tuesday Tip How To Calculate Your Debt To Income Ratio

Debt To Income Ratio Formula Calculator Excel Template

Private Mortgage Calculator 2022 Wowa Ca

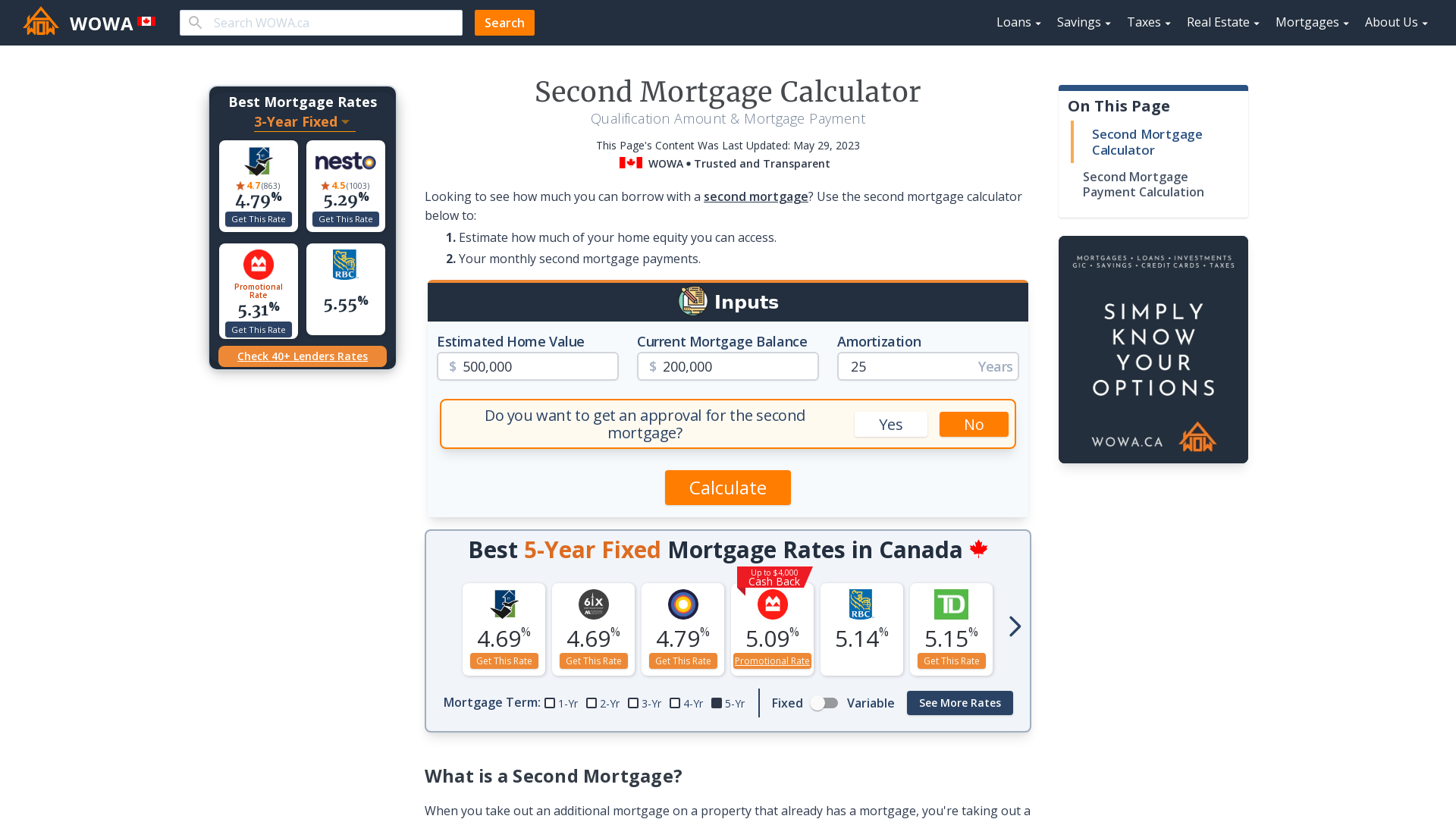

Second Mortgage Calculator Qualification Payment Wowa Ca

What Bills Are Calculated In The Debt To Income Ratio Quora

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Debt To Income Ratio

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help