Taxes that come out of paycheck

Was about 2829 in 2020. See how your refund take-home pay or tax due are affected by withholding amount.

Tax Information Career Training Usa Interexchange

Scrapping the national insurance increase will give workers back some of their pay packet above the national insurance threshold of 12570 saving 155 a year for someone paid 25000.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. Choose an estimated withholding amount that works for you. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Use this tool to. The advantage of pre-tax contributions is that they lower your taxable income. While this does represent a progressive tax system the income tax rates.

Liz Truss has announced that a typical household will pay no more than 2500 annually for its gas and. To qualify for a rebate you must complete a state tax return which must be filed by December 31. For a single filer the first 9875 you earn is taxed at 10.

So the tax year 2021 will start from July 01 2020 to June 30 2021. What Is The Average Amount Of Taxes Taken Out Of A Paycheck The average tax wedge in the US. Estimate your federal income tax withholding.

All Services Backed by Tax Guarantee. 1 hour agoThe Mini Cooper Electric Mazda MX30 and Hyundai Kona Electric are in the 30000s according to Edmunds. For those with house payments taxes are typically paid by mortgage companies through escrow accounts.

Texas state income tax. It will take the state until early October to print all 17. 1 you wont pay income tax on those contributions and 2.

2 days agoWe can guarantee no senior -- no senior will have to pay more than 2000 out of pocket for their drugs for the entire year no matter whether their bill is 50000. Others have several options to pay taxes. No more than 2000.

2 hours agoEnergy bills. America uses a progressive system in determining what employees pay in income tax. Pay by calling 770-531-6950.

Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. Kias Niro EV Hyundais Ioniq 5 Fords F-150 Lightning pickup the Volkswagen ID4 Kia. Mail a check to Hall County Tax Commissioner PO.

These are contributions that you make before any taxes are withheld from your paycheck. The tax wedge isnt necessarily the average percentage taken out of someones paycheck. Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut.

The first set of rebates will go out to taxpayers tomorrow September 9 according to governor David Iges office. The combined payments -- 325 for individuals or 650 for married couples filing jointly -- will be included in one paper check. This means that the amount required by the government is smaller for those who earn less.

The government uses federal tax money to help the growth of the country and maintain its upkeep. Too little could mean an unexpected tax bill or penalty. These are 0 12 22 24 32 35 and 37.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Box 1579 Gainesville GA 30503. Starmer condemns Truss for refusal to pay for support through windfall tax.

Texas tax year starts from July 01 the year before to June 30 the current year. Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed. There are seven tax brackets in 2020.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. This tax will apply to any form of earning that sums up your income whether it comes for employment or capital gains. 19 hours agoTruss rebuffed opposition calls for a new windfall tax even as she refrained from explaining how she would fund a plan meant to help the public pay energy bills skyrocketing because of Russias.

The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Figure out your filing status.

That will be followed by the arrival of a combination of 100000 paper checks and direct deposits on September 12. Most recent pay stubs most recent income tax return Use our Tax Withholding Estimator You should check your withholding if you. Ad Payroll So Easy You Can Set It Up Run It Yourself.

You will need your. How It Works. Youll sometimes hear this referred to as pre-tax income and it means two things.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. 13 hours agoTaxes are due Nov. You can also make pre-tax contributions by enrolling in flexible spending accounts FSAs and health savings accounts HSAs.

Only the very last 1475 you earned would be taxed at.

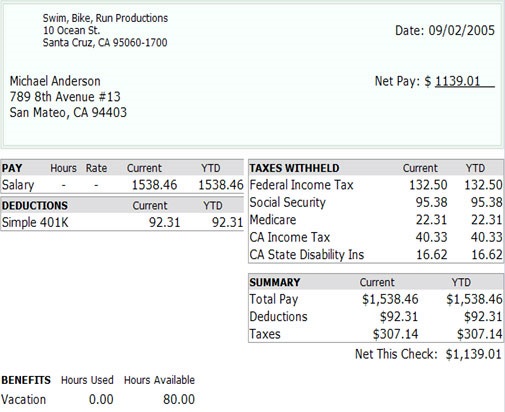

Understanding Your Paycheck Taxes Withholdings More Supermoney

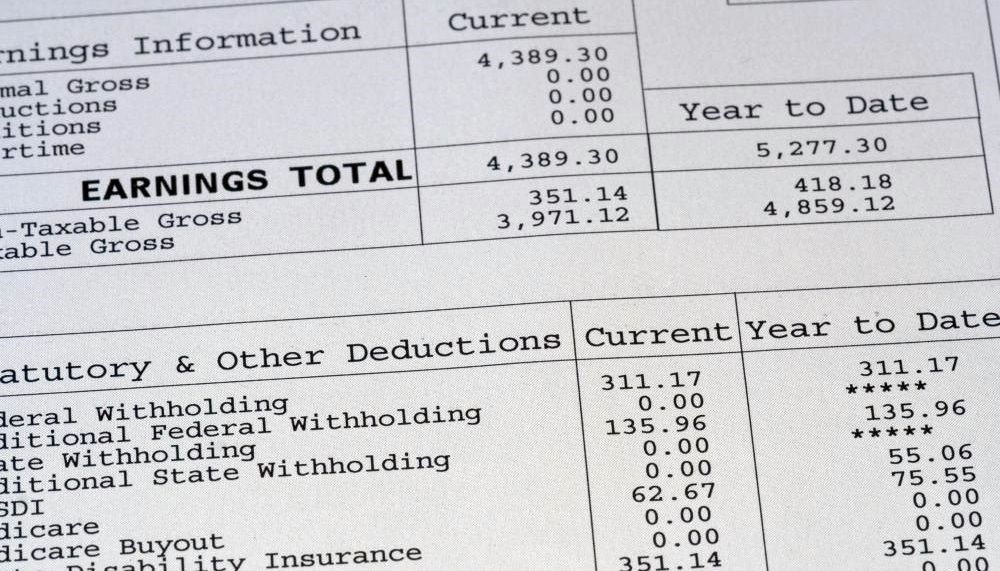

What Are Payroll Deductions Article

Understanding Your Paycheck Taxes Withholdings More Supermoney

Paycheck Calculator Take Home Pay Calculator

Understanding Your Paycheck

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Irs New Tax Withholding Tables

Paycheck Taxes Federal State Local Withholding H R Block

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding Your Paycheck Credit Com

Paycheck Calculator Online For Per Pay Period Create W 4

Different Types Of Payroll Deductions Gusto

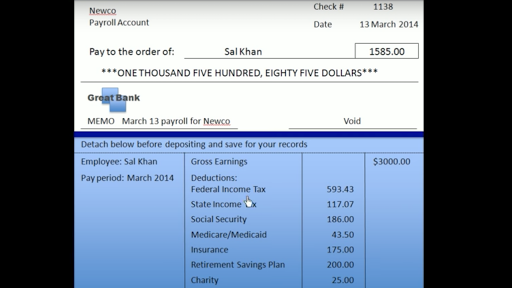

Anatomy Of A Paycheck Video Paycheck Khan Academy

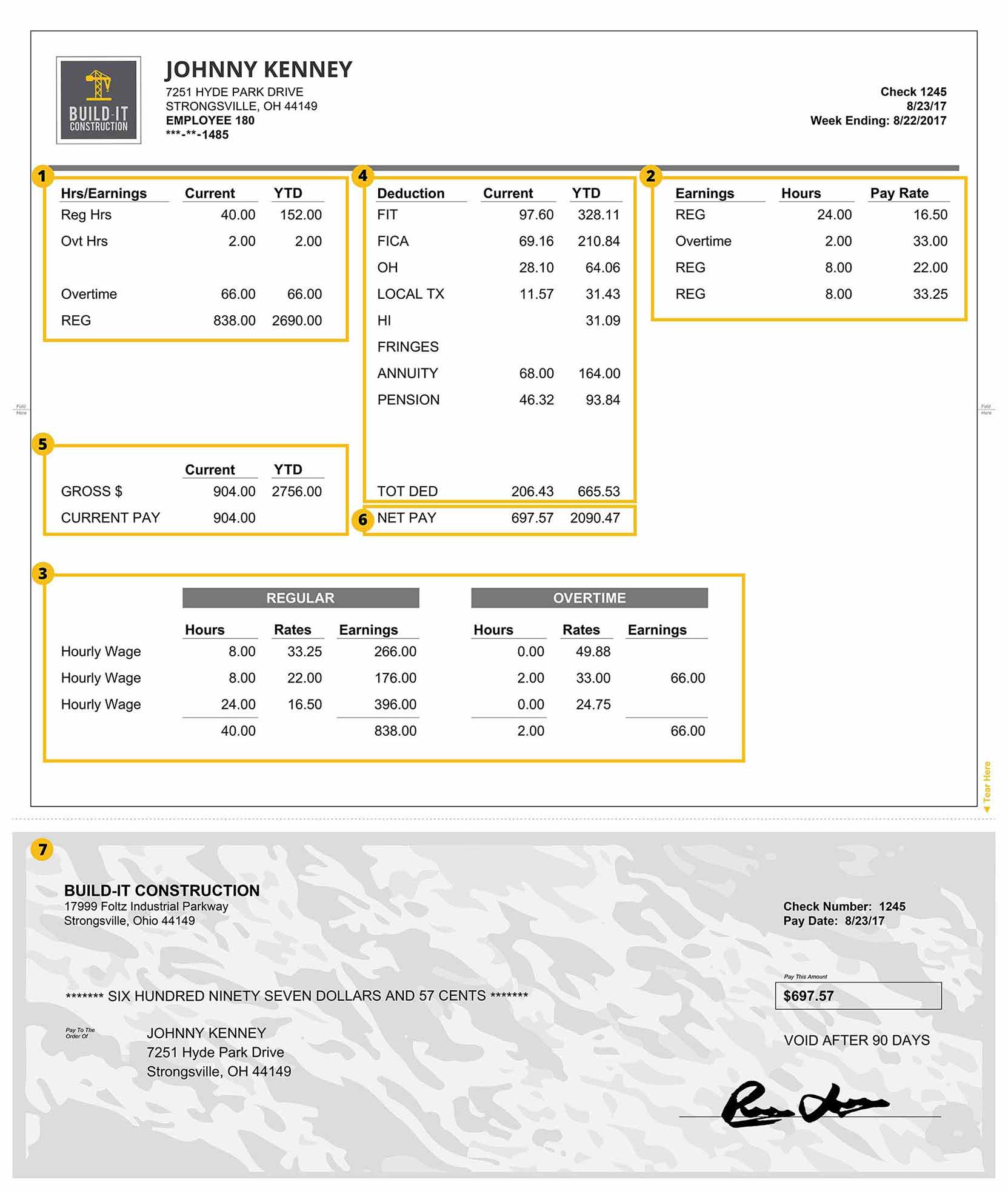

A Construction Pay Stub Explained Payroll4construction Com

What Are Employer Taxes And Employee Taxes Gusto